jcrosemann/iStock via Getty Images

Welcome to the Vanadium miners news. May saw lower vanadium prices and a steady month of vanadium news from the vanadium producers and junior miners.

Vanadium uses

Vanadium is traditionally used to harden steel. New Chinese rebar standards are requiring more vanadium. Also Vanadium Flow Batteries [VRFBs] are becoming increasingly popular especially for commercial energy storage, most notably in China. Vanadium Pentoxide [V2O5] is used in VRFBs and Ferrovanadium [FeV] is used in the steel industry.

Vanadium spot price history

Europe Vanadium Pentoxide [V2O5] Flake 98% 1 year chart – Price = USD 9.60/lb (China price not given)

Vanadiumprice.com![Europe Vanadium Pentoxide [V2O5] Flake 98% 1 year chart](https://static.seekingalpha.com/uploads/2022/5/29/37628986-1653876248984915.png)

China and Europe Ferrovanadium [FeV] 80% prices – China = USD 38.50/kg, Europe = USD 38.25/kg

Vanadiumprice.com![China and Europe Ferrovanadium [FeV] 80% prices](https://static.seekingalpha.com/uploads/2022/5/29/37628986-16538763844041271.png)

Vanadium demand versus supply

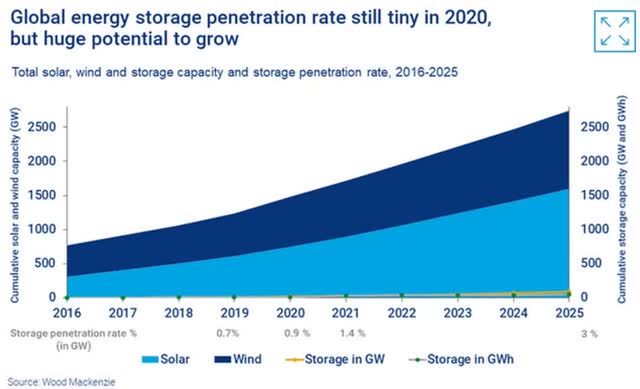

An April 2021 Wood Mackenzie report stated:

Global energy storage deployment surged a remarkable 62% in 2020, with 5 GW/9 GWh of new capacity added. This brought the total energy storage market to more than 27 GWh. Furthermore, we expect the global (energy storage) market to grow 27-fold by 2030.

WoodMac forecasts high growth ahead for solar, wind and energy storage

Woodmac

An early 2021 Roskill post stated:

The vanadium market is set to tighten over the year and more so in 2022, driven by higher demand but also by tighter supply, as Chinese steel slag producers are running close to capacity. Outside of China, incremental supply will also be limited and come mainly from AMG’s new facility in Ohio, USA, and Bushveld’s Vametco gradually increasing its production in South Africa… Vanadium redox batteries (VRBs) could become a major market for vanadium amid growing demand for energy storage, should the technology develop…On the supply side, Roskill does not expect significant tonnages from new projects to enter the market before 2024.

In 2017 Robert Friedland stated:

We think there’s a revolution coming in vanadium redox flow batteries…

Vanadium market news

On May 5 S&P Global reported:

‘Overlooked’ vanadium may gain energy storage market from pricey lithium-ion: Mines & Money…Vanadium has been overlooked in the current mineral commodities cycle, and stands to gain market share as lithium risks pricing itself out as a battery material for the energy grid storage market, the Mines and Money conference heard May 5. “One (mineral) that’s been overlooked in this entire cycle is vanadium, which has huge market opportunities,” James Hayter, Investment Advisor at Baker Steel Capital Managers…”Vanadium is more efficient than lithium-ion in the grid storage market.”…Prices for ferrovanadium — an alloy of iron and vanadium used in quality steelmaking — have also risen fast: in April averaging also just over double its average of last year. However, future supply concerns are currently not so acute as for lithium, despite the market outside China and Russia being dominated by just two major producers: Bushveld Minerals in South Africa and TSX-listed Largo Resources with mine resources in Brazil.

On May 25 The North West Star reported:

Richmond Vanadium gets ‘coordinated project’ status…which should ease the path to future approvals. The 1.8 billion tonne Richmond-Julia Creek Vanadium Project is considered “world class” with a completed Pre-Feasibility Study and is the first critical minerals project in Queensland to gain the coordinated project status. Horizon Mining Limited have signed a Sale & Purchase Agreement and following completion of the sale in the June Quarter 2022 Richmond Vanadium Technology will own 100% of the project. Richmond Vanadium CEO Dr Shaun Ren said the IPO and ASX listing was taking shape…

Vanadium miner news

Vanadium producers

Glencore [LSX:GLEN] [HK:805] (OTCPK:GLCNF)

Glencore is a large vanadium producer, but vanadium production represents only a small portion of their revenue.

On April 28, Glencore announced: “First quarter 2022 production report.”

On May 24, Glencore announced:

Glencore reaches coordinated resolutions with US, UK and Brazilian Authorities. Glencore cooperated with authorities and has made substantial investments to enhance its Ethics and Compliance Programme. Under the terms of the US resolutions, Glencore will pay penalties of $700,706,965 to resolve bribery investigations and $485,638,885 to resolve market manipulation investigations by the Department of Justice (“DOJ”) and the Commodity Futures Trading Commission (“CFTC”)…

AMG Advanced Metallurgical Group N.V. [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

AMG Vanadium is a leading provider of products and services for the metals, manufacturing, refinery and petrochemical industries. AMG Vanadium produces ferrovanadium and related ferroalloys from spent refinery catalysts using a proprietary pyrometallurgical process.

On May 4, AMG Advanced Metallurgical Group N.V. announced: “AMG Advanced Metallurgical Group N.V. reports first quarter 2022 results.” Highlights include:

- “The commissioning of AMG Vanadium’s second spent catalyst recycling facility in Zanesville, Ohio is proceeding as planned. We continue our ramp up phase and the plant is forecast to achieve at run rate capacity in the fourth quarter of 2022.

- Shell & AMG Recycling B.V. (SARBV) continues to pursue circular refinery residue opportunities globally…

- AMG’s first lithium vanadium battery (“LIVA”) for industrial power management applications is proceeding as planned and commissioning has begun at AMG Graphite located in Hauzenberg, Germany.”

Financial Highlights

- “Revenue increased by 53% to $403.9 million in the first quarter of 2022 from $264.0 million in the first quarter of 2021.

- EBITDA was $54.8 million in the first quarter of 2022, 93% higher than the first quarter 2021 EBITDA of $28.3 million, marking the seventh straight quarter of sequential improvement.

- Annualized return on capital employed was 19.8% for the first three months of 2022, more than double the 9.4% for the same period in 2021.

- AMG’s liquidity as of March 31, 2022, was $478 million, with $308 million of unrestricted cash and $170 million of revolving credit availability.

- The Company has maintained its final 2021 declared dividend of €0.30 to be paid on May 12, 2022 to shareholders of record on May 10, 2022.”

You can view the latest investor presentation here.

Bushveld Minerals Limited [LN- AIM:BMN] (OTC:BSHVF)

Bushveld is a diversified AIM-listed resources company with a portfolio of vanadium, tin and coal assets in Southern Africa and Madagascar.

No significant news for the month.

You can view the latest investor presentation here.

Largo Inc. [TSX:LGO] [GR:LR81] (LGORF)(NASDAQ:LGO)

Largo Inc. is a pure-play vanadium pentoxide producer from their Maracás Menchen mine in Brazil as well as a producer of VRFBs.

On May 11, Largo Inc. announced: “Largo reports first quarter 2022 financial results and provides adjusted 2022 guidance; Announces intention to commence normal course issuer bid.” Highlights include:

- “Revenues of $42.7 million, a 7% increase over Q1 2021; Revenues per pound sold1 of $8.67, a 34% increase over Q1 2021 mainly due to stronger vanadium prices.

- Cash provided before non-cash working capital items of $5.8 million, a 55% decrease over Q1 2021.

- Net loss of $2.0 million vs. net income of $4.1 million in Q1 2021.

- Total V2O5 equivalent sales of 2,232 tonnes vs. 2,783 tonnes in Q1 2021; Lower quarterly sales due to ongoing global logistical challenges and lower production in Q4 2021.

- Cash balance of $78.4 million exiting Q1 2022; Net working capital. surplus of $124.7 million following increase in in-transit vanadium inventory.

- V2O5 production 2,442 tonnes (5.4 million lbs3) vs. 1,986 tonnes (4.4 million lbs3) in Q1 2021

- Operating costs of $29.0 million vs. $28.2 million in Q1 2021, and cash operating costs excluding royalties per pound1 of V2O5 equivalent sold of $3.97 vs. $2.87 in Q1 2021.

- 2022 Guidance Update: The Company has increased its annual cash operating cost excluding royalties1 guidance from $3.20 – 3.40 per lb sold to $3.90 – 4.30 per lb sold mainly due to a rise in input raw material costs, a stronger Brazilian currency estimate and lower production in Q1 2022; V2O5 equivalent production guidance lowered from 12,250 – 12,750 tonnes to 11,600 – 12,400 tonnes; V2O5 equivalent sales guidance lowered from 12,250 – 12,750 tonnes to 11,000 – 12,000 tonnes.

- Construction of the Company’s ilmenite concentration plant commenced in April as part of its previously announced titanium dioxide (“TiO2”) pigment project. TiO2 content is expected to be sourced from the vanadium ore created from the Company’s ongoing operations, which is expected to contribute to the Company’s “two-pillar” business strategy as a low-cost vanadium supplier with an emerging vanadium battery business.

- Configuration of Largo Clean Energy’s (“LCE”) vanadium redox flow battery (“VRFB”) product development and stack manufacturing center, in Massachusetts, U.S. to be complete in May 2022; LCE began producing stacks and purifying electrolyte in the new facility with prospective customer visits having occurred in May 2022.

- Largo Physical Vanadium (“LPV”) continued to make progress (see press released dated April 19, 2022) and is seeking all applicable regulatory and stock exchange approvals to become a publicly listed physical vanadium holding company that will purchase and hold physical vanadium to provide potential investors with ownership and exposure to vanadium.

- The Company announces that it intends to commence a normal course issuer bid (“NCIB”) to purchase for cancellation its common shares (the “Common Shares”)…

You can view the latest investor presentation here.

Energy Fuels Inc. [TSX:EFR] (UUUU)

Energy Fuels state they are “the No. 1 uranium producer in the U.S. with a market-leading portfolio”, as well as being a small vanadium producer.

On May 18, Energy Fuels Inc. announced: “Energy Fuels announces Q1-2022 results, including continued robust balance sheet, market-leading U.S. uranium position & rare earth production.” Highlights include:

- “…..Through May 31, 2022, the Company has sold approximately 150,000 pounds of FeV (roughly 230,000 pounds of V2O5) from its existing V2O5 inventory at a gross weighted average price of about $20.65 per pound of V contained in FeV (roughly $11.00 per pound V2O5), capitalizing on recent market strength. The Company expects to continue to sell vanadium with increasing prices and is evaluating the potential to resume vanadium recovery at the Mill, where its tailings pond solutions contain an additional 1.0 to 3.0 million recoverable pounds of V2O5.”

Ferro-Alloy Resources [LON:FAR]

FAR is developing the giant Balasausqandiq vanadium deposit in Kyzylordinskaya Oblast of southern Kazakhstan. FAR state: “The ore at this site has a significantly higher grade than all other primary vanadium extraction sites, which allows for much lower processing costs.”

On April 29, Ferro-Alloy Resources announced: “Final results for the year ended 31 December 2021.” Highlights include:

- “Strategic long-term investment by Vision Blue Resources and co-investors of US$ 10.1m to date to fund completion of Balasausqandiq feasibility study and expansion of existing operations.

- Improved financial results: Revenue increased 96% to US$ 4.7m (2020:US$ 2.3m). Loss before tax of US$ 2.83m (2020: loss before tax of US$ 3.94m). The Group held cash of US$ 2.81m at 31 December 2021 (2020: US$ 0.707m).

- Improved outlook for 2022: Third roasting oven increased capacity by 50%. Group already operating profitably. Nickel recovery project will increase revenues from each tonne treated with no additional raw material costs.

- Price of vanadium pentoxide currently $12/lb, up from $5.4/lb at the beginning of 2021. Ferro-molybdenum and nickel prices up by 100% and 92% respectively from 1 January 2021 to date.”

Western Uranium & Vanadium Corp. (OTCQX:WSTRF)

Western Uranium & Vanadium Corp. own the Sunday Mine Complex which is an advanced stage mine property consisting of five interconnected underground mines in Colorado, USA.

No news for the month.

Investors can read the latest company presentation here.

Vanadium developers

Neometals [ASX:NMT] (OTCPK:RDRUY) (OTCPK:RRSSF)

Neometals 100% own the Barrambie Titanium Vanadium Iron Project in Western Australia. Barrambie’s Eastern Band is one of the highest grade hard rock titanium deposits globally.

On April 29, Neometals announced: “Quarterly activities report for the quarter ended 31 March 2022.” Highlights include:

Corporate

- “Cash balance A$65.2 million, receivables and investments of A$46.5 million and no debt.

- Neometals shares admitted to trading on the AIM market of the London Stock Exchange.“

Downstream – Materials Processing

Vanadium Recovery Project (“VRP”) (earning into 50:50 JV with Critical Metals Ltd)

- “Feasibility Study (AACE Class 3) for SSAB project (VRP1) advanced during the quarter and is on track for completion by end of June 2022.

- VRP1 Finnish plant site secured by project partner under long-term lease agreement with Port of Pori.

- VRP1 by-product evaluation trials result in offtake Letter of Intent from Betolar for potential use in green cement-based building products…

Upstream – Mineral Extraction Barrambie Titanium and Vanadium Project (“Barrambie”) (100% NMT)

- “Completion of gravity concentrate bulk samples from Menzies Pilot Plant and shipment post quarter-end to Jiuxing for commercial smelting trials planned to commence JunQ 2022.

- AACE Class 4 Pre-feasibility Study advanced and on track for completion in SepQ 2022…”

You can view the latest investor presentation here.

Australian Vanadium [ASX:AVL] [GR:JT71] (OTC:ATVVF)

Australian Vanadium is an emerging vanadium producer focused on their Australian Vanadium Project in Western Australia. VSUN Energy was launched by AVL in 2016 to target the energy storage market for vanadium redox flow batteries [VRFBs].

On May 11, Australian Vanadium announced: “Sale of Coates Nickel – Copper – PGE and Nowthanna Hill Uranium Projects….”

On May 20, Australian Vanadium announced:

Placement and SPP to raise up to $27.5m…Funds to be used predominantly to finance ongoing work at the Australian Vanadium Project and develop key downstream markets ahead of finalising debt financing and a Final Investment Decision.

On May 26, Australian Vanadium announced: “MOU with NHCE for Energy Market Vanadium Battery Project Development. VSUN Energy and clean energy developer NHCE to collaborate on Australia wide long duration energy storage projects.” Highlights include:

- “North Harbour Clean Energy (NHCE) developer of renewable energy and energy storage projects.

- MOU signed for collaboration on development and installation of vanadium redox flow battery (VRFB) projects and vanadium electrolyte supply.

-

NHCE is part of the $50M University of New South Wales and University of Newcastle Australian Government Trailblazer partnership recently awarded.”

Catalysts include:

- 2022/23 – Possible further off-take and/or JV partner announcements.

You can view the latest investor presentation here, or read “Australian Vanadium Managing Director Vincent Algar Talks With Matt Bohlsen Of Trend Investing.”

Technology Metals Australia [ASX:TMT]

The Company’s primary exploration focus is on the 100% owned Gabanintha Vanadium Project located 40km south east of Meekatharra in the mid-west region of Western Australia.

On April 28, Technology Metals Australia announced:

Kiln feed award launches MTMP implementation phase…Marks a key milestone in the progression of the MTMP into the Implementation Phase.

You can view the latest investor presentation here.

TNG Ltd. [ASX:TNG] [GR:HJI] (OTCPK:TNGZF)

TNG is an Australian resources company focused on the evaluation and development of its Mount Peake Vanadium-Titanium-Iron project. The Mount Peake Project is located 235km north-northwest of Alice Springs in the Northern Territory of Australia. TNG Ltd. is well advanced with a massive $4.7b NPV8%, but relies on titanium and iron with a lower grade vanadium by-product.

On April 28, TNG Ltd. announced: “March 2022 quarterly activities report.” Highlights include:

Mount Peake – Critical Minerals – Project

Vanadium-Titanium-Iron [NT] (TNG: 100%)

- “Agreement with SMS group (“SMS”) for a revised Project Execution Strategy allows enhanced delivery of key processing infrastructure for the Mount Peake Critical Minerals Project. This takes advantage of the recent changes in global conditions, supply chain management, logistics and cost inflation.

- Clough Projects Australia Pty Ltd (“Clough”) has progressed value engineering for the mining and processing operation at the Mount Peake mine site (“Mine Site”).

- Technical studies for the submission of a revised environmental impact report for the Project are progressed, with consultation of the Northern Territory Environmental Protection Authority.

- Subsequent to the end of the quarter, the Company commenced a water bore drilling and evaluation program to provide information required for the groundwater modelling work for additional process water required for the Processing Facility at the Mine Site.

- The pricing for TNG’s key products continues to be strong, despite additional market volatility amid fears of supply shortages due to global condition.“

TNG Alternative Energy

- “Commercial and technical parameters for the development of the “HySustain™” green hydrogen technology project in Darwin continued to be progressed in joint venture with Malaysian-based energy group AGV Energy & Technology.

- Following a formal request by TNG, the Northern Territory Government has reserved a site in Darwin Port’s Middle Arm precinct for the HySustain Darwin Project ahead of the application and lease negotiations.

- A Technology & Process Design Study was completed for the development of a high-purity Vanadium Electrolyte Production Facility to support the commercialisation of Vanadium Redox Flow Battery technology in Australia and enhance value from the Mount Peake product suite.“

Corporate

- “On 15 February 2022, TNG established a small shareholding sale facility (“Facility”) for certain shareholders with holdings valued at less than A$500 (”Eligible Shareholders”). The Facility closed on 4 April 2022 with proceeds expected to be paid to Eligible Shareholders on or shortly after 27 April 2022.

- The Company’s cash position at 31 March 2022 was $14.0 million.“

On May 4, TNG Ltd. announced: “TNG receives $3.7m research & development rebate.”

On May 24, TNG Ltd. announced:

TNG completes successful Aquifer extension water bore drilling program to support Mount Peake development…As previously advised, the water bore drilling and evaluation program was undertaken to provide a sustainable water supply for the entire Mount Peake Project with additional water resource information required for the groundwater modelling work being conducted by TNG’s appointed hydrological consultants, AQ2 Pty Ltd (“AQ2” – see ASX Announcement of 12 April 2022) for the revised Mount Peake Processing Facility.

You can view the latest investor presentations here.

Vanadium Resources Limited [ASX:VR8]

Vanadium Resources is a junior exploration company established with the purpose of exploring and developing gold zinc, lead, copper and other mineral opportunities. Vanadium Resources owns 74% of a globally significant vanadium project, the Steelpoortdrift [SPD] Project, in Gauteng Province, South Africa.

No significant news for the month.

You can view the latest investor presentation here.

King River Resources [ASX:KRR] (formerly King River Copper)

King River holds 785 square kilometres of mineral leases covering a unique geological feature in the Eastern Kimberley of Western Australia, called the Speewah Dome. The company state on their website: “The focus of King River Copper Limited is the exploration for Gold, Silver and Copper.” However their deposits also contain vanadium.

On May 10, King River Resources announced: “New Speewah vanadium testwork.” Highlights include:

- “Murdoch University salt roast testwork has reported excellent first pass results of up to 92% vanadium (V) extraction from a Speewah high grade vanadium-titanium magnetite concentrate.

- Investigations commenced into critical minerals funding options for KRR’s new Vanadium process flow sheet development to support the transition to renewable energy.”

You can view the latest investor presentation here.

VanadiumCorp Resource Inc. [TSXV:VRB][GR:NWN] (OTCPK:VRBFF)

VanadiumCorp Resource Inc. 100% owns the Lac Dore Vanadium-Iron-Titanium project in Quebec, Canada. The Company also has royalties on the Raglan Nickel-PGM mine. The Company is looking to take a vertically integrated approach and is also developing leading process technologies ‘VanadiumCorp-Electrochem Processing Technology’ and “Electrochem globally patented Electrowinning” technology.

No news for the month.

You can view the latest investor presentation here.

Phenom Resources Corp. [TSXV:PHNM] (OTCQX:PHNMF) (formerly First Vanadium Corp.)

The Carlin Gold-Vanadium Property hosts one of North America’s largest richest primary vanadium deposits, located in Nevada. Its West Jerome project targets a large scale high grade copper and zinc deposit in Arizona. Carlin has a Historic Inferred Resource 28Mt at 0.525% V2O5 (2010 SRK).

No news for the month.

Investors can read the latest company presentation here.

Graphite miners with potential vanadium projects

- Syrah Resources [ASX:SYR] (OTCPK:SYAAF) (OTC:SRHYY)

- NextSource Materials [TSX:NEXT]

- DNI Metals [TSXV:DNI] [GR:DG7N](OTCPK:DMNKF)

Other listed vanadium juniors

- BlackRock Metals (Private)

- Gladiator Resources [ASX:GLA]

- Golden Deeps [ASX:GED]

- Horizon Minerals [ASX:HRZ]

- Intermin Resources [ASX:IRC]

- Maxtech Ventures [CSE:MVT]

- New Energy Minerals [ASX: NXE] (formerly Mustang Resources)

- Pursuit Minerals [ASX:PUR]

- QEM Limited [ASX:QEM]

- Sabre Resources [ASX:SBR]

- Strategic Resources [TSXV:SR] (OTC:SCCFF)

- Trigon Metals Inc. [TSXV:TM] (OTC:PNTZF)

- Voyager Metals Inc. [TSXV:VONE][GR:9VR1] (OTC:VDMRF) (formerly Vanadium One Iron Corp.)

- Venus Metals [ASX:VMC]

- Victory Metals [TSXV:VMX]

VRFB Companies

- Protean Energy [ASX:POW] [GR:SHE1]

- Enerox GmbH (90% Bushveld/10% Cellcube Energy Storage Systems)

- Invinity Energy Systems (LSE:IES) (OTCPK:IVVGF)

EV metal miners royalties companies

- Electric Royalties [TSXV:ELEC]

Conclusion

Europe vanadium pentoxide spot prices were lower last month. China and Europe Ferrovanadium prices were also lower in May.

Highlights for the month include:

- ‘Overlooked’ vanadium may gain energy storage market from pricey lithium-ion: Mines & Money.

- Richmond Vanadium gets ‘coordinated project’ status. The project is being purchased by Richmond Vanadium Technology with an ASX IPO to follow.

- AMG’s commissioning of their second spent catalyst recycling facility in Zanesville, Ohio is proceeding as planned.

- Largo Inc. reported lower quarterly sales due to ongoing global logistical challenges and lower production. Lowers 2022 V2O5 equivalent sales guidance from 12,250 – 12,750 tonnes to 11,000 – 12,000 tonnes.

- Neometals Barrambie Titanium and Vanadium Project concentrate bulk samples from Menzies Pilot Plant shipped to Jiuxing for commercial smelting trials planned to commence JunQ 2022.

- Australian Vanadium Placement and SPP to raise up to $27.5m. Funds to be used predominantly to finance ongoing work at the Australian Vanadium Project ahead of finalising debt financing and a Final Investment Decision.

- TNG Ltd Mount Peake Critical Minerals Project agreement with SMS group for a revised Project Execution Strategy.

- King River Resources (using Murdoch University salt roast testwork) reported excellent first pass results of up to 92% vanadium extraction.

As usual all comments are welcome.