Justin Sullivan

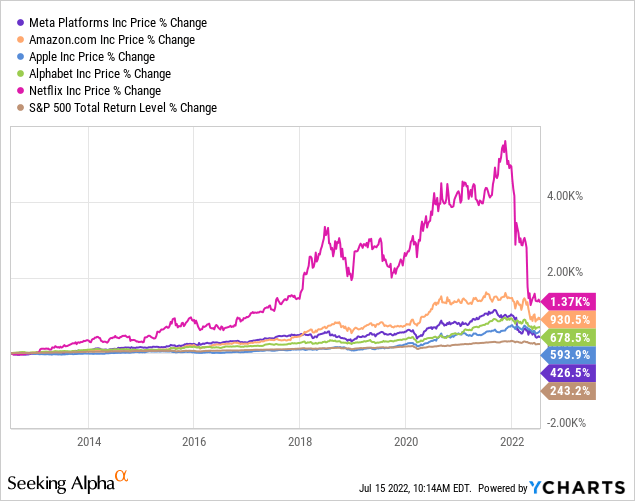

I consider all people here has read about the FAANG shares, as these major tech names have delivered extraordinary returns in excess of the previous ten years. Even though some of the providers have altered their identify more than that time, the letters symbolize Facebook/Meta Platforms (META), Apple (AAPL), Amazon (AMZN), Netflix (NFLX), and Google – or as it can be now recognized, Alphabet (GOOG, NASDAQ:GOOGL).

Any traders in these enterprises due to the fact 2012 have been very properly rewarded, with each individual enterprise easily outperforming the benchmark S&P 500.

But investing is a ahead-wanting game, so which of these firms should see the greatest total of achievement in the decade to arrive? While you could make a compelling scenario for any, my pick is Alphabet, and I’ll notify you why.

Small business Overview

Alphabet divides by itself up into two core Google-relevant segments: Google Services and Google Cloud, with a even more section for Other Bets.

The products and platforms at the heart of Google Services incorporate adverts, Android, Chrome, components, Gmail, Google Drive, Google Maps, Google Images, Google Enjoy, Search, and YouTube. These are all solutions that we come into get in touch with with each individual day I’m now working with Google Chrome and Google Look for to do a ton of the exploration for this short article. The hardware products also offered by Google consist of the Pixel smartphones, Fitbit, Chromecast, and the Google Nest Cams and Doorbell.

Google Cloud is the company’s cloud system & a challenger to the likes of Amazon’s AWS and Microsoft’s Azure. It also offers Google Workspace, which generates revenues from cloud-primarily based collaboration resources for enterprises these kinds of as Gmail, Docs, Travel, Calendar, and Meet.

A snapshot of just some of Alphabet’s offerings (Google)

The closing giving from Alphabet is the Other Bets part, which is primarily venture funds. It invests in rising firms at a variety of stages of improvement with a target for them to starting to be thriving, prosperous corporations in the medium to long expression. The most perfectly-acknowledged of these Other Bets is probably Waymo, an autonomous driving start-up.

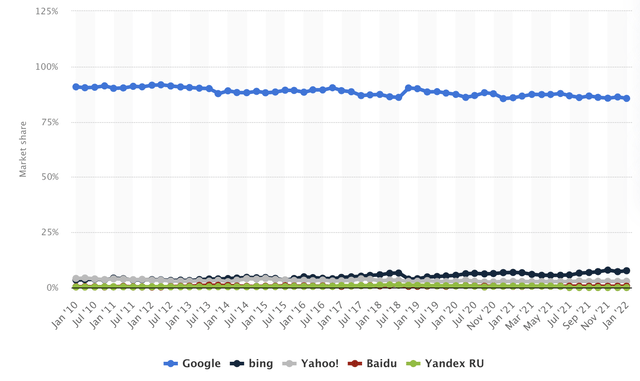

Alphabet has a sturdy business enterprise product across lots of of these different spots. In the lookup motor industry, Google is the obvious leader and has been for some time, with a global current market share over 85% as of January 2022 in accordance to Statista. When it comes to Look for, Google has apparent aggressive pros from its brand name identify as effectively as a technological benefit its device understanding has outperformed all other “rivals” around the final decade.

World wide Look for Engine Industry Share (Statista)

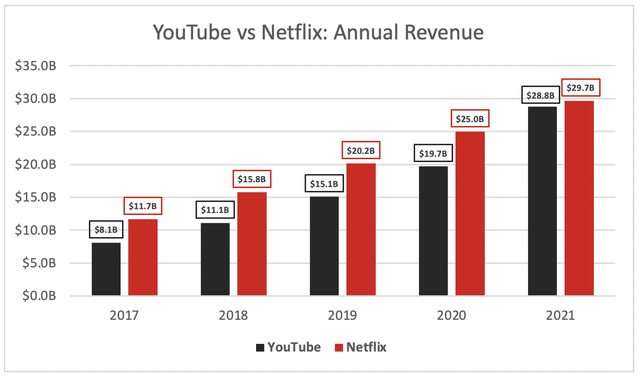

The enterprise also obtained YouTube back again in 2006 for a whopping $1.65 billion… which, provided YouTube’s latest general performance, appears to be like an absolute steal! In truth, YouTube grew revenues to an amazing ~$29 billion in 2021, pretty much overtaking the pure-participate in streaming leader & fellow FAANG member Netflix.

SEC Filings, Excel

Let us not forget about about Google Cloud it might even now be at the rear of leaders Amazon and Microsoft, but has the potential to be a sizeable income driver for Google around the impending a long time, as we have currently witnessed with AWS and Amazon (& as I highlighted in a recent report). Google is still incredibly a lot in the investment stage of its cloud infrastructure, and I feel its upcoming appears vivid right here far too.

It’s undeniable that Alphabet has a bunch of brilliant firms, with many dominating their main industries… but who cares? Specifically the exact could be claimed for the relaxation of the FAANG stocks. So heading on the assumption that all these firms have excellent business types, what separates Google from the rest of the pack?

Economic Fortitude

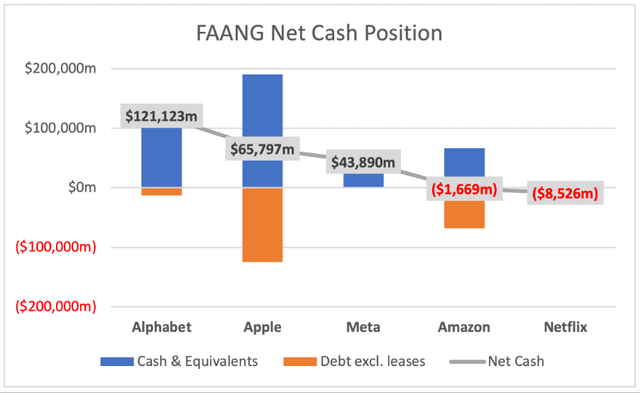

Just one of the major drivers for future advancement when it will come to these FAANG stocks is their potential to diversify, attempt out new matters, and explore enjoyable, ground breaking, and perhaps lifetime-changing technologies to create new profits streams – but in purchase to do that, the firms have to be both of those fiscally protected & also have a war chest of funds to devote. So, how do they stack up? Alphabet is in a league of its very own, with virtually double the web income place of its closest FAANG competitor Apple.

SEC Filings / Excel

This, blended with Alphabet’s frequent attempts to uncover and create the future ‘big thing’ to push their business enterprise forward ought to be a winning mix for shareholders. The business even calls out its solution to “Moonshots” in its yearly report:

Numerous providers get at ease performing what they have usually finished, producing only incremental variations. This incrementalism prospects to irrelevance above time, specially in technologies, where change tends to be revolutionary, not evolutionary. Persons considered we ended up mad when we acquired YouTube and Android and when we released Chrome, but individuals attempts have matured into key platforms for digital video clip and cellular units and a safer, well-liked browser. We carry on to glance towards the long term and to spend for the extensive term inside every of our segments. As we mentioned in the initial founders’ letter, we will not shy absent from large-hazard, superior-reward assignments that we consider in, as they are the critical to our extended-phrase achievement.

So not only does Google have the tradition to pull off these Moonshot makes an attempt, but it has the dollars on hand as nicely.

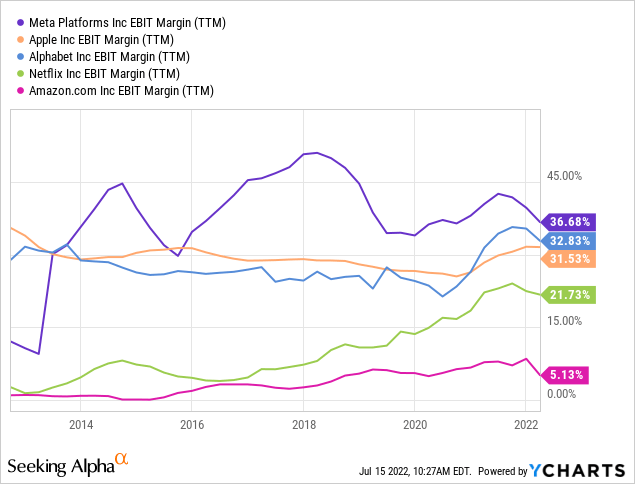

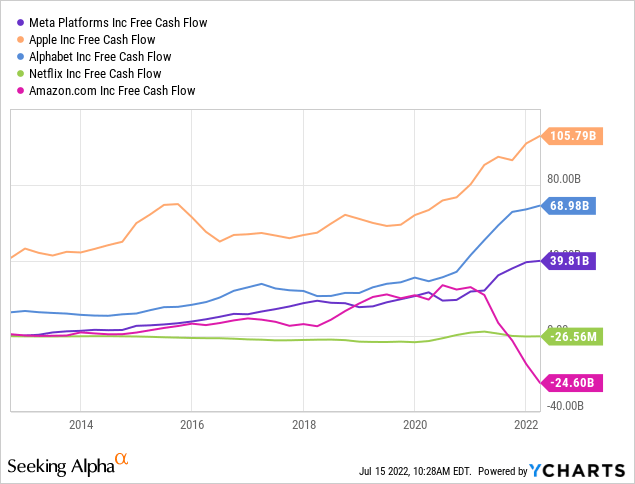

What about the enterprise product itself? Is it developed in a way this kind of that it will continue on to generate price for shareholders? I individually appear for solid margin profiles in any small business that I make investments in, and Google has consistently generated the 2nd best EBIT margins between any FAANG stock – second only to Meta, who I am not the most significant lover of for explanations that I mention in this prior short article.

Mix these high margins with an previously crazy money harmony, and you get a company that will not only go on to print funds, but is also in a ridiculously potent posture to just take risks and reinvest in any opportunities for growth – such as Google Cloud. If we also acquire a glance at free of charge income flow in absolute conditions, Google is also the second most effective of the FAANGs – this time 2nd to Apple.

It really is very clear that Google has one particular of the finest economic profiles of any FAANG stocks, but what does the long term maintain for this tech behemoth?

Expansion Prospects

Even though the earlier and existing have made Alphabet the organization it is nowadays, and assisted to make out a relatively impenetrable moat, the exact exact same can be explained for quite a few other FAANG shares. The dilemma now is no matter if or not any of these FAANG enterprises can continue their heritage of outstanding advancement, because this is what will be desired to retain shareholders pleased.

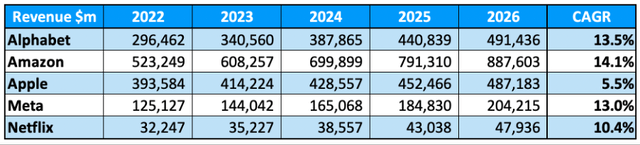

I believe that that Alphabet has a variety of tailwinds in its back again for the decade ahead secular progress in digital promoting (Google Look for), secular development in streaming (YouTube) secular development in cloud computing (Google Cloud), and many additional expansion stories that Alphabet is concerned in. However a quantity of buyers will make the incredibly similar scenario for all the other FAANG stocks, so let us acquire a glimpse at what the analysts imagine will come about more than the upcoming 5 many years, courtesy of TIKR.

TIKR.com / Excel

In conditions of profits advancement, Alphabet arrives out in its apparent favored position – next best, this time behind but a further distinct FAANG competitor, Amazon. While the variation between Alphabet, Amazon, and Meta is small in phrases of the expected CAGR, I believe this demonstrates that growth is unquestionably nonetheless there for these companies & they have an chance forward. Apple, just one of the stock market’s darlings, is undoubtedly not expected to develop at a similar charge to these organizations – so most likely we will commence looking at a transform at the top of the FAANG?

Valuation

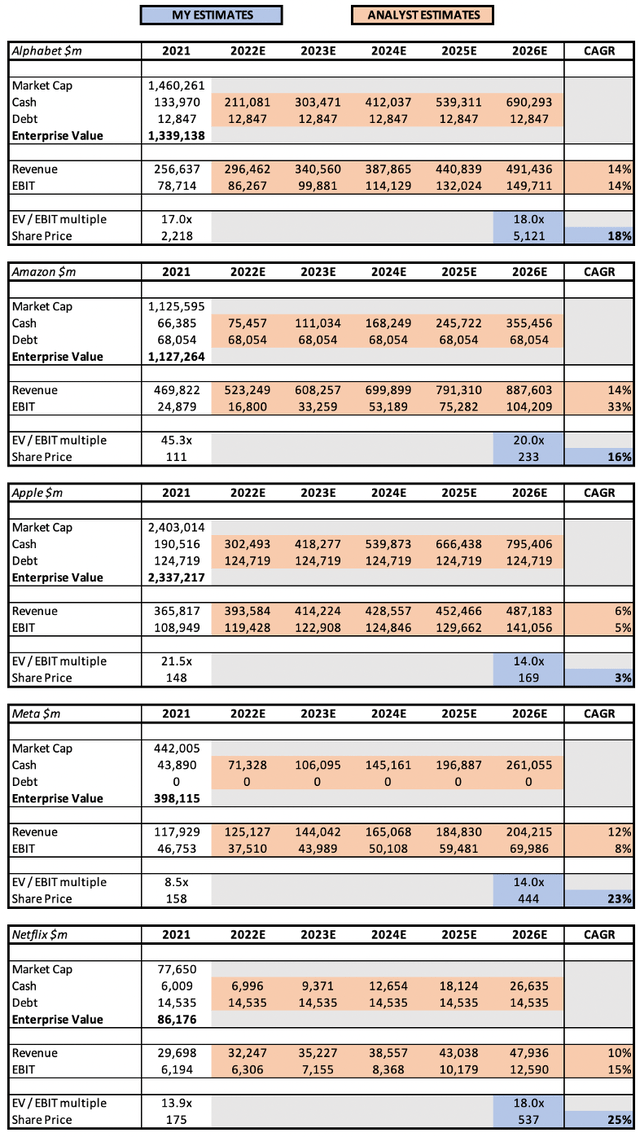

Let us get down to valuation, since at the conclusion of the working day these are all various corporations with diverse paths in advance, and hence they ought to all have unique valuations. I’m heading to use a a bit simplified variation of my conventional valuation design to get a rough thought of the individual valuations of these corporations in comparison to their 2026 likely.

TIKR.com / Excel

In situation it’s hard to see from the product, these are the outcomes for the share price CAGR by way of to 2026:

- Alphabet: 18%

- Amazon: 16%

- Apple: 3%

- Meta: 23%

- Netflix: 25%

In phrases of EV / EBIT multiples, I imagine that 12x represents an ideal many for a steady organization, and a 16x numerous represents an correct many for a stable-yet-escalating business. Amazon will get a bigger many due to the probable for EBIT margin growth, Apple gets a lower a number of owing to its lessen development costs, and Meta will get a reduced many thanks to the danger affiliated with both equally its image as a organization & the attempted metaverse change.

According to my product Meta and Netflix are delivering the most effective return, but why is this? Since I experience like these firms are presently most at risk of failing to realize their progress level. Meta is experiencing a genuine general public relations obstacle, and the go into the metaverse feels like a lengthy shot that HAS to function for the corporation, or else it could deal with a complicated upcoming. Netflix is likewise dangerous correct now, as it has been hemorrhaging subscribers and traders are awaiting a turnaround. I never consider that dangers of these levels exist for Alphabet, Amazon, or Apple. This points out why the two Netflix and Meta are now trading at valuations that appear to be way down below reasonable value – the marketplace is smart, and price ranges in this threat.

What is actually The Summary?

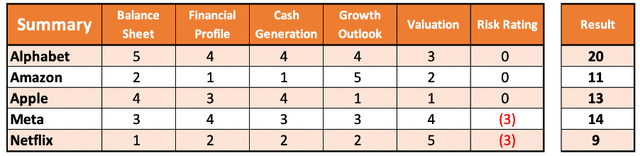

I’ve taken a search at Alphabet with respect to the other FAANG stocks, but how do I conclude which is the greatest of the bunch? Effectively, I’ll test and do it in a methodical way – by position each individual corporation in each group out of 5, and then viewing who receives the top score.

Excel

Although all the FAANG stocks excel in 1 or two particular spots, Alphabet is the only a person that has strengths across the board. I don’t claim to state that this simplistic position process offers an correct forecast of the achievement of these FAANG stocks – I personally choose Amazon as an expenditure in excess of Apple or Meta. But what it does demonstrate is that Alphabet appears to be a substantially a lot more nicely rounded company.

All of the providers above are excellent in their personal right. However I believe that Alphabet is really in a class of its very own, and will confirm to be the best FAANG stock above the approaching 10 years.