Prykhodov/iStock Editorial via Getty Images

Earnings season is upon us and with new numbers comes updated models. In this analysis, I will share my updated DCF model for Google (NASDAQ:GOOG)(NASDAQ:GOOGL) and discuss some key takeaways from their Q1 earnings call. Google experienced some headwinds in the quarter and projected them to persist throughout the year. These headwinds required me to make downward revisions to my model but the company still remains undervalued on a cash flow basis. I believe the market has over-reacted to these short-term obstacles and rank Google a buy at the current valuation.

DCF Model: Revenue Assumptions

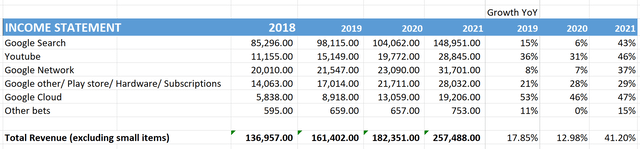

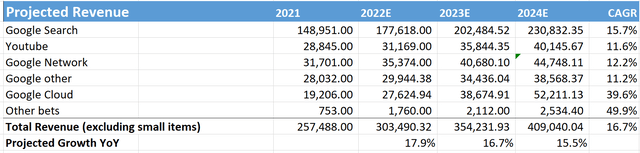

Google did not release specific guidance in Q1 but notes of a couple headwinds facing the company. Management warns the large growth rates in FY2021 are due to the lapping effect brought on by the lower ad spend within 2020. They also note the negative impact of a strong US dollar and the suspension of most commercial activities within Russia. Below is a revenue breakdown of Google’s sales over the last 4 FYE:

(Author’s calculations)

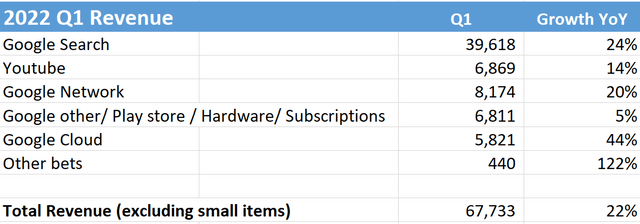

Below is their FY2022 Q1 numbers with YoY growth:

(Author’s calculations)

Google’s topline growth of 22% is impressive considering the macro environment and currency headwinds. On a constant currency basis, including hedging gains (not shown above), revenue would have grown 26%.

My immediate takeaways from their Q1 numbers are the following:

- Google Search is performing better than I anticipated.

- YouTube growth is slower than I anticipated and is facing strong headwinds particularly in Europe.

- Google Network continues to show strong growth with an expanding user base.

- Google other is dealing with price changes within the Google Play store and will disappoint throughout the fiscal year. This is offset somewhat by strong Pixel/ YouTube subscription sales.

- Google cloud will continue to compound with heavy investment and a fast growing TAM.

- Other bets remains unpredictable and a margin killer for now.

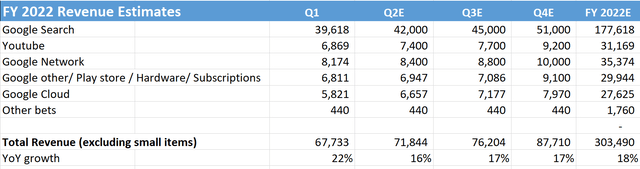

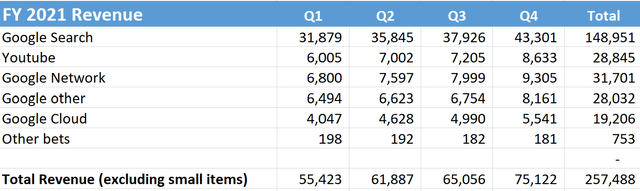

Below are my FY 2022 projections for Google compared to their actual FY 2021 results:

(Author’s calculations) (Author’s calculations)

After Q1 results, I revised my FY 2022 sales projections down from 307B to 303.5B. This change is due to the headwinds YouTube faces and the negative impact the price changes will have on Google Play store. However, this is partially offset by increased Google Search revenue.

Below are my sales projections for the next 3 fiscal years which will be used within my model:

(Author’s calculations)

For years beyond FY2022, I project YouTube and Google Other segments to re-accelerate their growth. Within FY 2022, YouTube will be heavily impacted from foreign exchange and weakness in Europe. These headwinds will create weaker comps YoY and will give YouTube time to regroup. Prior to Q1, YouTube was growing at an exceptional rate leaving me to believe the current headwinds will not affect the long term growth drivers. However, YouTube does face a certain level of competition risk and investors need to closely follow the level of engagement on the platform. Furthermore, once Google Other laps the price changes to Google Play store in Q4 2022, growth should resume derived from Google’s expanding portfolio of hardware and YouTube subscription growth.

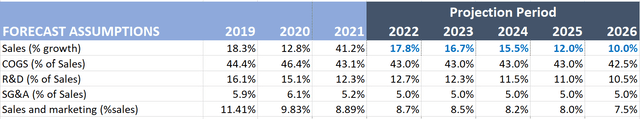

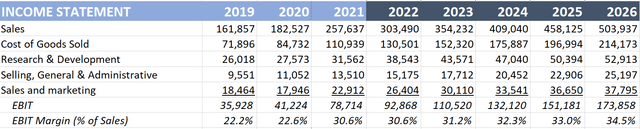

Operating Margins

With projected topline revenue the next step is determining gross margin and operating costs. In FY2021, Google increased their EBIT margin from 23% to 31%, due to phenomenon revenue growth and scale. However, management does not expect large margin growth over the coming years due to increased expenses driven by data center and headcount growth. Google is investing heavily into their Cloud business and is less focused on short-term profitability. Investors should welcome these investments as they will undoubtedly bring expectational value over the long-term but the impacts on cash flow need to be accounted for. When comparing Q1 EBIT margins YoY they remained flat at 29.5%, proving expenses are matching revenue growth. With that in mind below are my EBIT projections:

(Author’s calculations) (Author’s calculations)

For FY 2022, I project EBIT margin to remain flat compared to 2021. Google’s revenue growth will be fully offset from increased spending. Looking forward, I project Google to slowly increase their margin as their cloud business matures and begins to operate more profitably. Google’s services business had a 37% operating margin in Q1, proving how much the Cloud and Other bets segments are weighing down their overall margin.

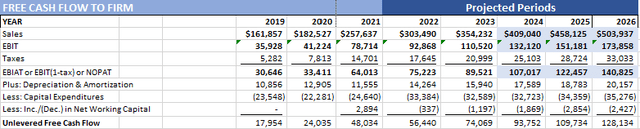

Unlevered Free Cash Flow

For my Unlevered Free Cash Flow calculation, I used EBIT from above and subtracted taxes of 19% for all projected periods.

For Capital Expenditures, I follow managements guide for a meaningful increase within FY2022. Google looks to continue building their technical infrastructure globally with servers being the largest component. For years beyond FY2022, I project Capex spend to remain elevated but under FY2022 levels. Within Q1, Google announced they spent 4B on office facilities. I consider these one-time purchases and lowered the gross amount for FY2023.

For Depreciation and Amortization, I increase the amount going forward considering Google’s large Capex spend.

Lastly, I project Net Working Capital to remain relatively flat moving forward.

(Author’s calculations)

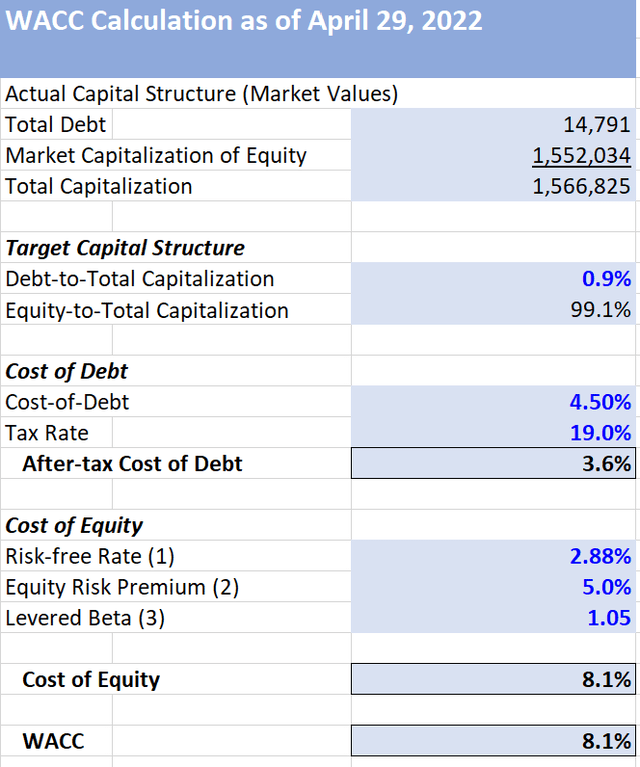

WACC

My model will use a discount rate of 8.1% calculated below:

(Author’s calculations)

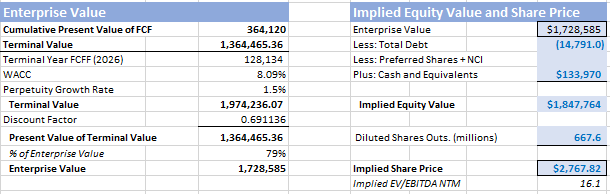

Enterprise Value/ Implied Share Price

(Author’s calculations)

After discounting future cash flows and calculating a terminal value my model suggest an implied share price of $2767.82, which represents a 18.7% upside from where Google was trading at on April 29, 2022.

How to use a DCF Model

Investors know that a firm’s value is derived from the present value of all its future cash flows. Therefore, by discounting a company’s future cash flows, a DCF model can calculate an intrinsic value. Using intrinsic values can help investors ensure a margin of safety and to avoid the short-term irrationality of markets. In theory this makes sense but DCF’s have many shortcomings. The models are based on cash flow assumptions made many years into the future. The uncertainty of these assumptions increases every year into the future and can never be perfect. Furthermore, the rate used to discount future cash flows has an enormous impact on the results. Deciding an appropriate discount rate remains theoretical and can be a shortfall within all models. Many believe the proper way to use DCF models is to consider them within a range of outcomes. No one DCF model is perfect, but by considering a range of assumptions an intrinsic value can be deciphered.

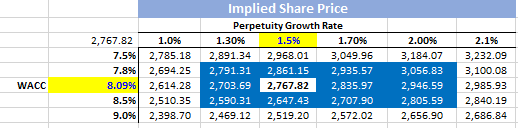

Sensitivity Analysis

To further prove this point, below is a sensitivity analysis showing the changes in implied share price as I slightly adjust my discount rate and perpetuity growth rate.

(Author’s calculations)

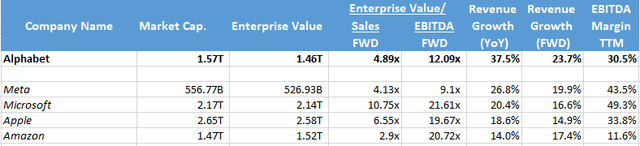

Industry Comparison

Google looks cheap in isolation but it is important to also compare it on a relative basis. Below I compare Google to its mega-tech counterparts, Meta (FB), Microsoft (MSFT), Apple (AAPL) and Amazon (AMZN).

Author’s Calculations using Seeking Alpha Numbers

When comparing Google on a relative basis the company also seems undervalued. This discount compared to its peers can likely be explained by the nature of Google’s ads business and the uncertainties surrounding it.

Risks

By far the biggest risk facing Google continues to be the regulatory issues the company faces. Google makes most of its revenue through its “walled garden” digital advertising business. Leveraging their closed eco-system, Google holds a tight grip on a large portion of the digital ads market. As tech conglomerates face increased scrutiny world-wide regarding anti-competitive practices, Google remains a prime target for unpredictable legislation. Within my model, I assume no material regulatory action and an environment where Google continues to successfully operate their digital ads business with a competitive moat.

Defining “The Moat”

For any business to make excess profits over the long run, they must operate with a strong economic moat. Being the most material to my model, I breakdown Google Search’s economic moat and explain why its competitive advantages allow me to comfortably project growth at a remarkable scale. Below are three interlinked factors that are responsible for Google Search’s exceptional moat:

Intellectual Property: All search engines require a complex search algorithm to supply information efficiently and comprehensively. Google’s superior search algorithm has proven to be near impossible to replicate and contributes to their competitive advantage.

Scale: Google search benefits from scale on multiple fronts. With the most search data on the market, Google can continuously improve their algorithm further increasing their IP lead. Furthermore, by leveraging their data advantage Google can target ads more efficiently than competitors.

Brand Awareness: Google has become the accepted verb for running an internet search. This combined with their superior algorithm ensures Google’s scale which leads to their competitive advantage.

When considering these factors, Google Search’s economic moat remains largely unchallenged. Regulatory issues aside, I believe Google Search is undoubtedly poised for continued excess profits beyond FY2022.

Final Thoughts

Google is a cash flow machine with a large competitive moat. Considering their intrinsic value, Google offers investors growth at a very reasonable price and a high margin of safety. I remain bullish on their heavy investments into cloud infrastructure and believe it will pay high dividends over the long-term. However, regulatory issues will continue to haunt Google and investors need to incorporate this into their valuation estimates. Therefore, I rank Google a buy rather than a strong buy, strictly due to the unpredictability surrounding regulatory risks.