Israeli thermal energy storage company Brenmiller Energy (TASE: BNRG) has filed a prospectus with the US Securities and Exchange Commission (SEC) for a Nasdaq Initial Public Offering. The move comes nearly five years after the company held its IPO on the Tel Aviv Stock Exchange (TASE).

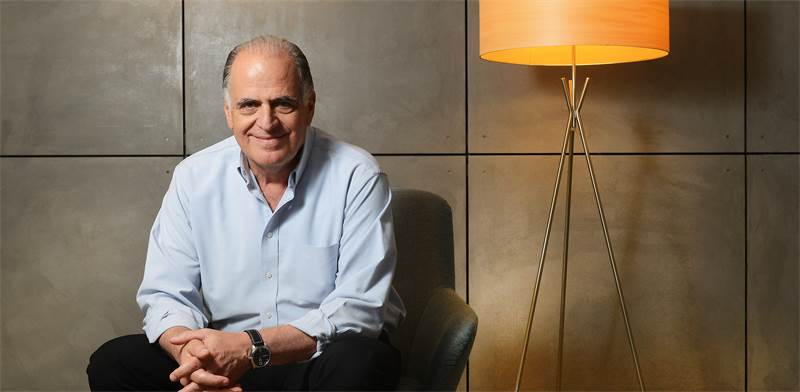

Brenmiller Energy operates in the thermal energy storage sector based on technology developed by chairman and CEO Avi Brenmiller, who founded the company in 2012, after previously founding and managing Solel, which was sold to Siemens.

RELATED ARTICLES

Brenmiller Energy back from the brink

Rani Zim to invest NIS 50m in Brenmiller

Brenmiller engaged in 13m financing MOU with EIB

Brenmiller Energy is traded on the TASE at a market cap of NIS 232 million, tens of percentage points below its IPO valuation in 2017. The fall in its market cap stems, among other things, from uncertainty regarding its ability to generate revenue and meet the financing terms extended to it by Bank Leumi (TASE:LUMI). At the end of 2020, Brenmiller Energy’s market cap peaked at NIS 555 million but has since more than halved.

According to the prospectus filed with the SEC, Brenmiller Energy will list on Nasdaq without raising any capital although some of its shareholders may sell shares as part of the offering. Israeli financial institutions Alpha Capital and Mor Investments will together sell up to 3.3 million shares currently worth about NIS 58.5 million.

Avi Brenmiller himself holds a 36.4% stake in the company and Israeli businessman Rani Zim has a 15.1% stake. Neither will sell any shares in the planned Wall Street offering.

In 2021, Brenmiller reported revenue of $395,000 and a net loss of $10.3 million, compared with a loss of $9.5 million in 2020.

Published by Globes, Israel business news – en.globes.co.il – on April 25, 2022.

© Copyright of Globes Publisher Itonut (1983) Ltd., 2022.