![8 best salon and spa software with payroll [2022] 8 best salon and spa software with payroll [2022]](https://investecaccountants.com/wp-content/uploads/2022/12/Top-Hourly-Payroll-Process-Tips-for-2022.jpg)

Not every hairstyle will work for every client. The same thing applies to salon software and small businesses — not every type of payroll software will be the right fit for your salon or spa.

Many salon owners just buy the same software as their competitors. The problem is that what works for one business might not work for another. You have to consider the unique needs, goals, and challenges of your business.

If you’re looking for new payroll software, we’ve already done all the research on the best salon software with payroll here to speed up making the decision.

What is salon or spa payroll software?

Salon or spa payroll software is a business management tool that is specific to salons and spas. It allows salon owners to run payroll and manage tax payments and documents according to their unique employee and commission bands.

By contrast, standard payroll software is varied and caters to a wide range of industries such as retail and restaurants. They aim to cover most businesses’ general needs and wants.

But salons and spas have highly specific challenges like:

- Keeping accurate track of wages with last-minute cancellations and no-shows

- Managing the complicated wage and commission tiers in the payroll process

- Accounting for deductions like booth rental and payment for products

Not all payroll software will cater to these needs. Salon owners might find the wrong payroll software doesn’t actually reduce their workload and maybe even increases it. That’s why it’s crucial to find software designed with salons or spas in mind.

The 8 best salon/spa software with payroll in 2022

Here is our shortlist of the best salon and spa management software with payroll features. We’ve also included the table below as a handy cheat sheet of all the main features and prices.

| Platform | Main Features | Starting Price |

| Homebase |

|

$39 per month + $6 per person |

| MyTime |

|

$129 per month (if billed annually) |

| Wellness Living |

|

$59 per month |

| DaySmart Salon |

|

$29 per month |

| Mangomint |

|

$165 per month (for 10 service providers) |

| Zenoti |

|

Customized based on customer needs |

| Phorest |

|

Customized based on customer needs |

| MindBody |

|

$129 per month |

1. Homebase

With Homebase, you get more functionality than a swiss army knife. We have free timesheets, a time clock, and auto-scheduling to get you started. Homebase also offers time tracking and can convert timesheets into hours and wages in seconds.

Customize the settings to your salon’s specific employee and commission structure, no matter how complicated it is. And best of all, don’t worry about taxes. Homebase calculates all your payments to employees, the state, and the IRS so you can breathe easy.

Homebase’s mobile app is also perfect for small businesses with constantly revolving doors of customers and staff on their feet. Employees can access their schedules, timesheets, and earnings at any time and make changes at the click of a button without disturbing the flow of business.

2. MyTime

MyTime’s basic package includes scheduling, POS, and appointment booking, as well as the analytics and select reporting features for payroll. It has a handy resource management feature. This lets you automatically deduct the cost of the style products self-employed staff use from wages.

Source: https://www.mytime.com/m-staff-management

3. WellnessLiving

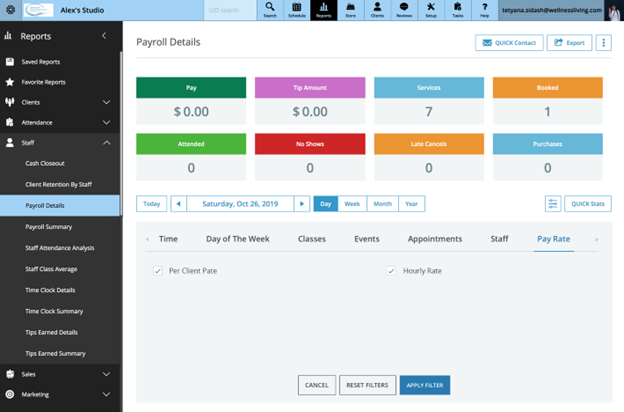

Wellness Living provides you with automatic payroll tracking for $59 per month. Upgrade to take advantage of their loyalty program feature. It has a digital leaderboard with prizes so you can incentivize making sales. Wellness Living’s software has many features that might take some time to learn, but customers can lean on their customer support team to guide them through the process.

Source: https://www.wellnessliving.com/blog/october-2019-release-notes/

4. DaySmart Salon

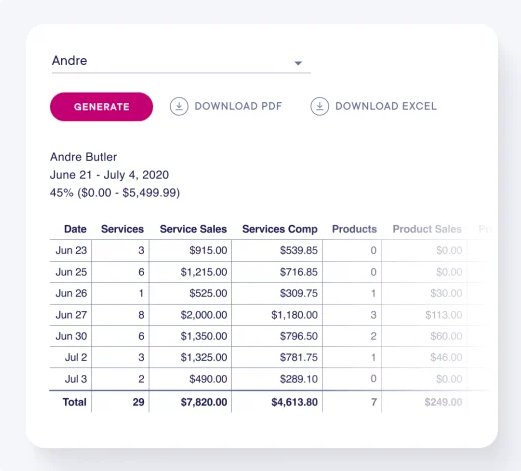

DaySmart Salon has a complete package of payroll processing tools, such as payment processing and a convenient app. It also throws in a nifty sliding scale set to make it easy to pay flat-rate and tiered commissions.

Source: https://www.daysmartsalon.com/features/payroll/

5. Mangomint

Mangomint generates payroll reports based on your employees’ hours worked, commission, upsells, and tips. The cash-out feature is tricky at first but doesn’t take long to learn. If you need a lot of support getting started, customers say that Mangomint’s support team is quick to respond and dedicated to solving any problem.

Source: https://www.mangomint.com/features/reporting/

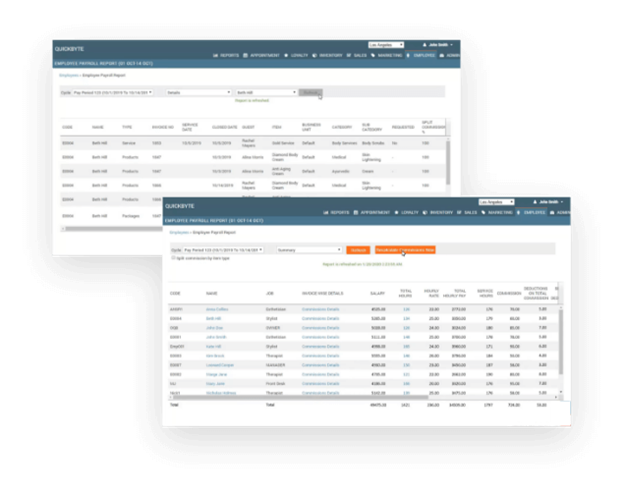

6. Zenoti

You get all the basics of payroll processing with Zenoti’s app. Many features can be overwhelming–especially for newcomers to payroll software. Luckily, customers find that Zenoti’s 24/7 online customer support team and scheduled sessions get them through any challenges.

Source: https://www.zenoti.com/spa-salon-reporting-analytics

7. Phorest

Phorest’s brightly-colored app helps you monitor your staff’s clock in and out times. You can choose whether to pay staff by rostered hours or the time clock feature. There is a dedicated business advisor for customers, but Phorest doesn’t include this in their Starter plan.

Source: https://support.phorest.com/hc/en-us/articles/360018249040-How-do-I-view-the-staff-schedule-by-month-view-

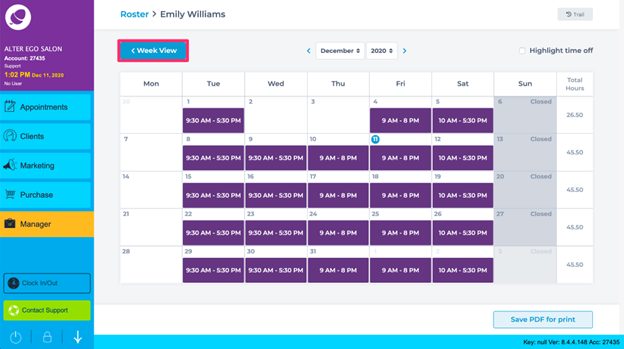

8. Mindbody

Mindbody is a great all-in-one software for any health and wellness business, particularly those with larger teams. In addition to payroll reporting, it offers a range of social media marketing tools to boost sales. On the flipside, it can be too complex for businesses with less than ten people.

Source: https://support.mindbodyonline.com/s/article/203256603-Payroll-report?language=en_US

How to know which payroll software to choose for your salon or spa

Choosing the right payroll software for your salon or spa will depend on your specific business needs. Before committing to a platform, take some time to think through the following questions:

How big is your budget?

First things first, decide how much you can put aside for payroll software. The prices vary wildly between the different brands and then again between their payment plans. Prioritize choosing software that’s the right fit for your business needs. You don’t have to spend a lot to get the features you want.

What are your business goals?

Future plans are another important factor. Right now, maybe you’re just five friends on the same hourly rate working out of your garage – something basic payroll software could handle. But if you plan on expanding your business – hiring more employees, introducing online booking, and taking on new clients – consider getting more robust software.

Ask yourself questions like:

- Will I expand my business into other areas?

- Will I open more locations in the future? Approximately how many?

- How much will my team grow?

- What types of employees will I hire?

Will it help me with scheduling?

Think about how long you spend redoing appointment schedules because of no-shows and cancellations. If you spend hours on this, consider a salon payroll software with built-in payroll and scheduling features.

Does it have a mobile app?

Depending on your business, you might be on your feet all day. That means you’ll want easy access to your software no matter what you’re doing. You don’t want to keep dashing between your salon floor and your computer all day. Choose payroll software with a mobile app so you can check on the go.

Is it user-friendly?

Salons and spas are busy places. You want intuitive payroll so you can make changes quickly between spa appointments and your other day-to-day tasks. Choose software that updates in real-time, so you don’t experience any delays while waiting for information either.

Does it have customer support?

Customer support is essential if you’re not very tech savvy. Speedy responses are a lifesaver when there’s a problem with time-sensitive issues like paychecks or tax filing.

What have others said about it?

Last but not least, read through some customer reviews. If the software ticks all your boxes but has a lot of complaints, it may be safe to rule it out. It probably isn’t delivering on all of its promises.

What to consider when managing payroll for a salon or spa

If you only have salaried workers on flat-rate commission, Excel will probably do. Beyond that, you open yourself up to tax errors, incorrect wages, and fines.

When choosing payroll software, two major factors to consider are employee status and commission structure. The more types you have of each, the more complicated your payroll will be.

Consider a robust payroll software if you have a mix of the following:

Employee status

It’s easy to get booth renters, independent contractors, and employees mixed up. Let’s keep it simple. The key differences between each person are:

- where they work

- how much autonomy they have

- if they pay tax

Employees

Employees work in one place for an hourly rate or by salary. They can negotiate the terms of their contract, but you make the rules. The trade-off is that you’re responsible for paying the tax on their payroll.

Booth renters

Unlike employees, booth renters work from one location and pay a monthly fee for their booth and equipment. Employers don’t have a say over things like their working hours, clients, or prices. Booth renters collect their own payment from the checkout or a personal POS device.

Independent contractors

Independent contractors are similar to booth renters, but they don’t stick to one location or pay rent. They are usually temporary. For example, some salon owners use contractors to cover the holiday rush.

As independent contractors are responsible for their own tax, they also set their own terms. They will invoice your business for their services.

Commission structure

A commission is a fee you pay staff for selling a product or performing a service. This money gets added to their standard pay. Commission has different tax guidelines that vary from state to state. Ensure you know them and that your payroll software can calculate them correctly.

Flat-rate commission

A flat-rate commission is a fixed percent that your staff earns from each sale, service rendered, or referral. For example, if a stylist upsells a bottle of the salon’s shampoo for $60 and her commission is 30%, she keeps $18. Typically, senior employees get a higher percentage than newer, less experienced ones.

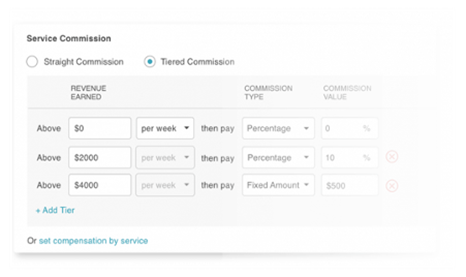

Tiered commission

With tiered commission, you set different payment tiers. The percentage the employee gets depends on which tier they reach. So, an employee could get a 20% commission for $500 worth of sales but 30% for $1000.

5 benefits of salon software with payroll

If you’re still on the fence about going all-in on salon software, here are some of the benefits that make it worthwhile.

Easier employee shift scheduling

Many payroll software platforms like Homebase include free shift planning features. With scheduling automation, you can generate timesheets and calculate wages in seconds. You can also factor in availability, roles, and the max hours your staff should work. That way, you keep your employees happy and avoid paying out extra in overtime.

Streamlined communication

Communication is a key part of excellent staff management in salons and spas. It boosts productivity and teamwork among your employees.

Payroll software streamlines communication by storing all the information you need in an easily accessible place. You can file all your employee’s W-4s and easily distribute their W-2s and 1099s. That way, everyone can answer their own questions via the app and you can cut down on a lot of questions and confusion.

Some salon software also lets you notify employees about changes or problems with their payroll. Everyone stays up to date, and you can fix any issues faster.

Improved operational performance

With an efficient payroll system, you can automate your workflow from start to finish. The software can handle appointment booking and scheduling right through to payment processing and ending with payroll. Business management becomes faster and sleeker. It also makes the customer experience much simpler.

When you cut time on paperwork, you have more hours to spend on high-value activities like training your employees, building relationships with your customers, and sales strategies to grow your business.

Accurate payroll management

Tax errors cost small businesses like salons and spas thousands of dollars every year. Avoid this issue with payroll software. Software like Homebase ensures you stay tax-compliant and don’t incur any fines from the IRS. There’s also less work for you to do double and triple checking all your paperwork for mistakes.

Payroll software often includes a time tracking system through POS devices too. They record every credit card transaction so you can check your employees’ earnings in real-time.

Keep track of information easily

Payroll software gives you a complete overview of sales and payroll. You can see who is making sales and getting the most commission. That makes it easier to tell who deserves a promotion, a pay raise, or a permanent position at your salon.

It also helps you spot problems faster. For example, what if nobody ever hits the sales they need to reach the highest percentage in your tiered commission? Maybe it’s too high, and that can be quite demoralizing. It might be time to lower it to something more reasonable.

What salon and spa payroll software can do for your small business

If your business is experiencing growing pains, it’s probably a sign that you need to level up. Looking for the best payroll software for your salon or spa will take some time, but the benefits you’ll enjoy down the road make it worthwhile. With the right payroll software, you can save tons of time and streamline your processes to maximize your business growth.

You might think: “Why bother spending time on research when you can cancel a software subscription?” But you can spare yourself a lot of wasted hours and frustration by making the right choice for your business from the outset.